Content

- Key Reminders when Planning to Take Advantage of the New York Pass-Through Entity Tax (PTET)

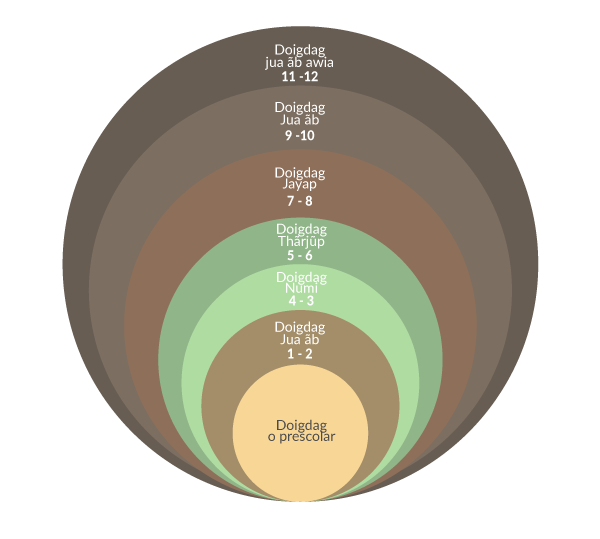

- steps: How couples and single parents can prepare for child care costs

- Section 179: main points and limitations

- Property Used Primarily (51%) for Business

- What is the Special Depreciation Allowance?

- responses to “2022 Section 179 Tax Deduction Updates: Increases for Expensing Maximum and Phase-Out Purchase Limit”

- Different methods of asset depreciation

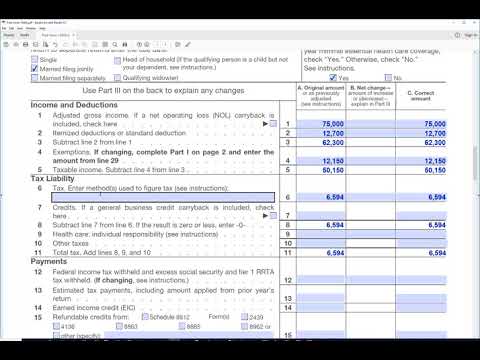

You go back to a prior year – 2021, for example – and amend the return to change the amount of Section 179 that was taken off the return. Laura, who has been working with clients for years in utilizing Section 179, notes that past frustrations are eliminated with the permanent status of the deduction. This post is designed to give you a high-level understanding of how Section 179 works for manufacturers in particular.

- This means that an SUV placed in service in 2019 is subject to a $25,500 Section 179 limit.

- If this convention applies, the depreciation you can deduct for the first year that you depreciate the property depends on the month in which you place the property in service.

- You refer to the MACRS Percentage Table Guide in Appendix A to determine which table you should use under the mid-quarter convention.

- Luckily, the IRS recognizes the importance of investing in your business and offers immediate tax savings for certain asset purchases through Section 179.

Once made, the election may not be revoked without IRS consent. You multiply the reduced adjusted basis ($288) by the result (40%).

Key Reminders when Planning to Take Advantage of the New York Pass-Through Entity Tax (PTET)

Trusts and estates are ineligible to utilize the deduction . In addition, owners or investors that are considered passive are not entitled to the deduction even if the business is eligible since the income from the activity is not deemed trade or business income. Disallowed deductions due to trade or business income limitations are carried forward indefinitely and can potentially be utilized in a future tax year.

Is it better to take Section 179 or bonus depreciation?

Section 179 offers greater flexibility but also caps the benefit. Bonus depreciation has no limitations but may force a company to “waste" depreciation that it could benefit from in future years.

If a Understanding Asset Depreciation & Section 179 Deductions spends more than $2.7 million on property, the Section 179 deduction will be reduced by the overage amount. Section 179 is a tax deduction that allows businesses to write off all or part of the cost of qualified property and equipment, up to a limit, during the first year it was purchased and placed into service. Working with an experienced tax accountant will ensure that you claim the maximum allowable bonus depreciation deduction. It is also important to note that there are separate depreciation limits for vehicles. If your business has purchased a vehicle or truck in 2022, new tax codes allow you to get your total tax break up front instead of spreading the deduction out over the life of your vehicle or asset.

steps: How couples and single parents can prepare for child care costs

If you dispose of GAA property in an abusive transaction, you must remove it from the GAA. In June 2024, Make & Sell sells seven machines to an unrelated person for a total of $1,100. These machines are treated as having an adjusted basis of zero. Expensed costs that are subject to recapture as depreciation include the following.

For 15-year property depreciated using the 150% declining balance method, divide 1.50 (150%) by 15 to get 0.10, or a 10% declining balance rate. If you sell or otherwise dispose of your property before the end of its recovery period, your depreciation deduction for the year of the disposition will be only part of the depreciation amount for the full year.

Section 179: main points and limitations

Section 179 allows owners to write off the entire https://intuit-payroll.org/ purchase for the year they buy it. An estimated value of property at the end of its useful life. Real property, generally buildings or structures, if 80% or more of its annual gross rental income is from dwelling units. Passenger automobiles; any other property used for transportation; and property of a type generally used for entertainment, recreation, or amusement. An addition to or partial replacement of property that adds to its value, appreciably lengthens the time you can use it, or adapts it to a different use. An intangible property such as the advantage or benefit received in property beyond its mere value.

For certain qualified property acquired after September 27, 2017, and placed in service after December 31, 2022, and before January 1, 2024 , you can elect to take an 80% special depreciation allowance. An election to take a section 179 deduction for 2022 can be revoked without IRS approval by filing an amended return. The amended return must be filed within the time prescribed by law. Under the income forecast method, each year’s depreciation deduction is equal to the cost of the property, multiplied by a fraction. For more information, see section 167 of the Internal Revenue Code.

Real property, such as buildings and their structural components, does not qualify. Also excluded from the deduction are land and improvements made directly to the land. Before you take Section 179 and/or bonus depreciation deductions, consult with your tax or legal advisor. While it’s true that the deductions effectively reduce your tax burden for the year in which the equipment was purchased, you may also give up future years’ depreciation, thereby impacting subsequent years’ tax burdens as well. You are a sole proprietor and calendar year taxpayer who operates an interior decorating business out of your home.

- In the past, bonus depreciation only covered 50% of an asset’s cost upfront, but as of the 2020 bonus depreciation rules this is now 100%, so now both methods let you deduct the entire cost in the same year.

- “Qualifying property” is tangible personal property used in business and having a useful life of at least six years.

- Subcontractor invoices and paid bills show that your business continued at approximately the same rate for the rest of the year.

- Instead of using the 200% declining balance method over the GDS recovery period for property in the 3-, 5-, 7-, or 10-year property class, you can elect to use the 150% declining balance method.

- The tangible property regulations or the “repair regulations” are often overlooked and underutilized by real estate businesses.

- You must use ADS for all property you place in service in any year the election is in effect.